FarmWise is an agricultural technology company that has developed a hardware enabled, AI-powered software technology stack to create agricultural equipment that can see, understand and act at the plant level. This technology stack is FarmWise’s Intelligent Plant System (IPS) which has been developed based on years of rigorous in-field experience and commercial utilization.

Interview with Tjarko Leifer, CEO of FarmWise.

Easy Engineering: A brief description of the company and its activities.

Tjarko Leifer: FarmWise’s mission is to enable farmers and ag equipment OEMs to reimagine every farming task with machinery that can perceive, understand, and act at the plant level in real time with the IPS Platform.

FarmWise uses the IPS Platform in our own Vulcan implement. Vulcan performs automated vegetable crop cultivation and weeding. Today, farmers in California and Arizona use Vulcan to massively reduce labor costs of vegetable crop farming.

FarmWise also offers the IPS Platform to ag equipment OEMs and is currently in discussions with a number of companies to develop new and enhanced machines that leverage the FarmWise IPS Platform.

E.E: What are the main areas of activity of the company?

T.L: Two main areas of activity:

1. Develop, manufacture, sell and support customers of FarmWise’s Vulcan implement. Customer adoption started in California and Arizona on the west coast of the USA. Geographic and crop expansion is planned.

2. Work with ag equipment OEMs to leverage the FarmWise IPS Platform for other ag equipment segments (for example precision spraying and automated cultivation of other crop types)

E.E: What’s the news about new products/services?

T.L: In 2023, FarmWise announced the commercial launch of their Vulcan weeding implement. Vulcan is built using the FarmWise Intelligent Plant System (IPS) Platform and incorporates FarmWise’s five years and tens of thousands of acres of vegetable crop cultivation and weeding experience from the prior Titan generation. Customer deliveries of Vulcan started in Q4 2023 and are scaling quickly throughout 2024. Vulcan is already setting productivity records for customers, including completing more than 8 hectares in a single shift with its 6-meter width, saving the farmer $5,000 in one day.

E.E: What are the ranges of products/services?

T.L: FarmWise’s core offering for farmers is the Vulcan smart cultivation and automated weeding implement.

With ag equipment OEMs, FarmWise partners closely with them to leverage the IPS Platform to enable new use cases for computer vision and AI-powered machines.

E.E: What is the state of the market where you are currently active?

T.L: The agricultural equipment market is rapidly evolving because of maturing computer vision, AI and robotics technologies on one hand and because of labor shortages and the need for more sustainable farming practices on the other hand. The era of ag equipment that can see, understand and act at the plant level in real time has the potential to automate challenging labor tasks and reduce crop inputs like fertilizers and crop protection chemistry thereby saving farmers money on input costs while also benefiting the environment.

E.E: What can you tell us about market trends?

T.L: Key trends include increasing adoption of robotics, AI, and automation in agriculture to address labor issues and boost efficiency. There is also growing interest in precision agriculture techniques and data-driven farming enabled by new technologies.

E.E: What are the most innovative products/services marketed?

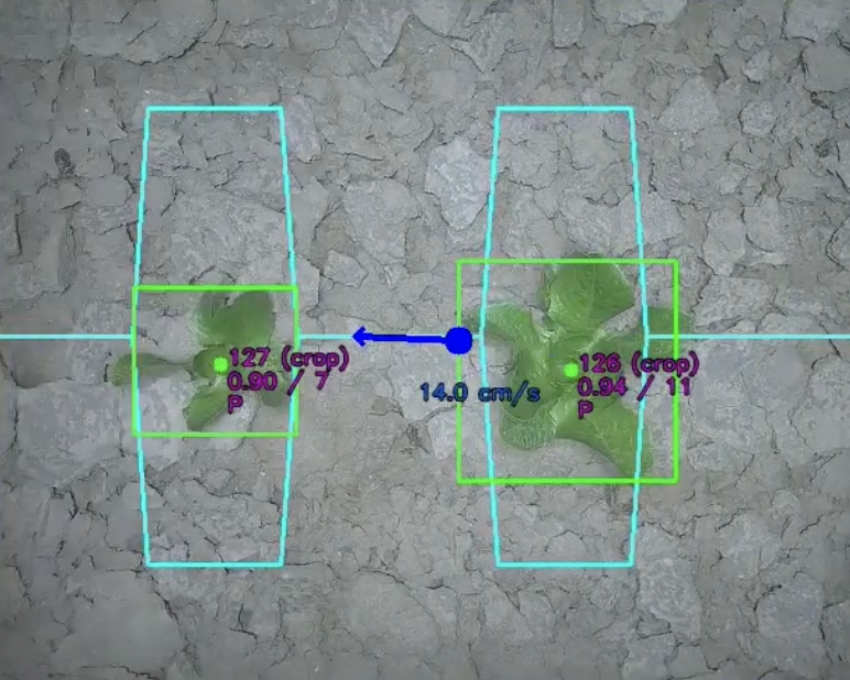

T.L: FarmWise’s automated cultivation and weeding implement, Vulcan, stands out for its ability to identify crop and weed stems using advanced computer vision, allowing precise robotic weed removal while avoiding crop damage.

E.E: What estimations do you have for the beginning of 2024?

T.L: We are in the early stages of what will become pervasive adoption of computer vision, AI and advanced robotics in agriculture. High value crops were substantial labor and chemical inputs can be saved are the first economic uses cases.

The adoption curve will mirror what is seen in the automotive industry: new technologies are first adopted in the premium segment. As volumes increase and prices decrease, new technologies become options on the mid-range and then finally the entry-level models. Ultimately productive new technologies become standard across all segments.