Assel is a privately owned, limited liability enterprise with industry experience since 1982 and 40 years of experience within electronics assembly.

The company specializes in Electronics Manufacturing Services (EMS) with primary focus on high mix, high complexity assembly that requires engineering contribution, supply chain management competencies and extensive production capabilities in the area of electronics assembly and electro-mechanical integration. Assel is located near Gdańsk, just 20 minutes’ drive from the airport.

Interview with Przemysław Prolejko, Business Development Manager at Assel.

Easy Engineering: What are the main areas of activity of the company?

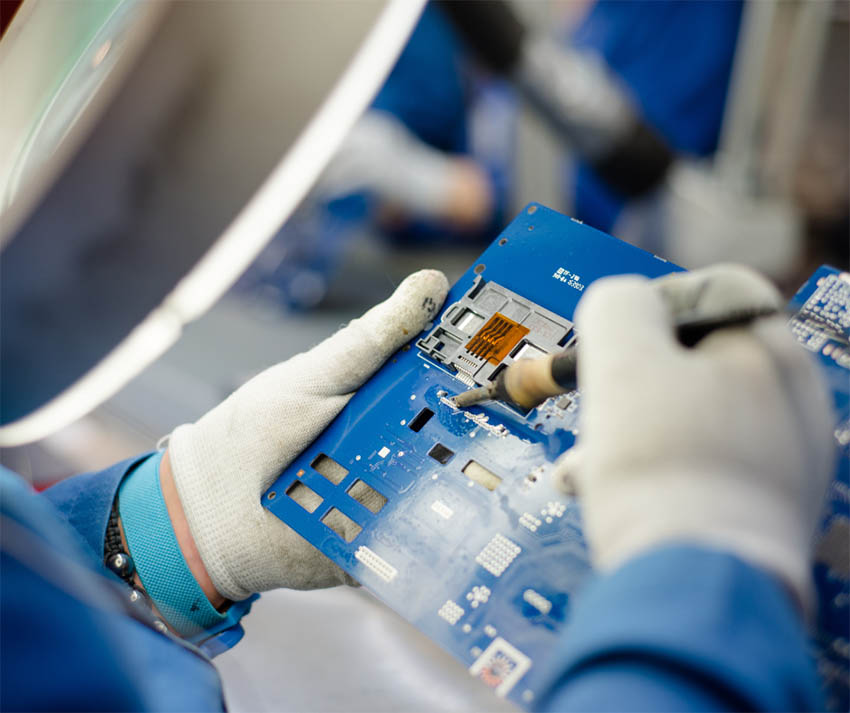

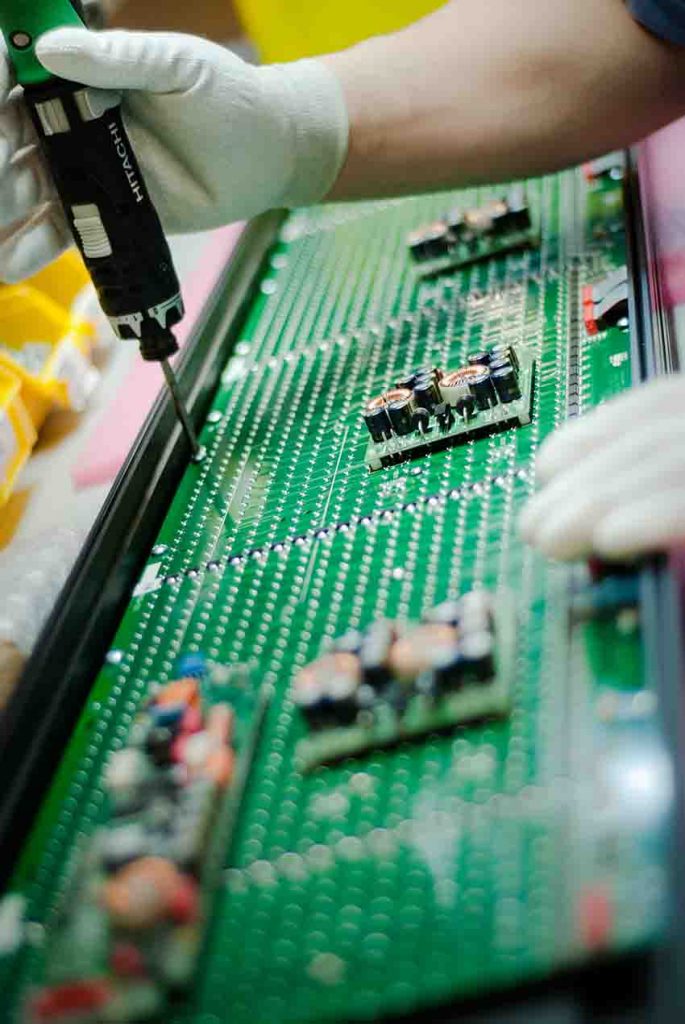

Przemysław Prolejko: Assel’s main scope of services are: PCB assembly, Box-build, and electo-mechanical integration, including cabinet assembly. Our factory is equipped with a broad range of equipment including three state-of-art equipment SMT lines (capacity of 550,000 cph), THT capabilities (wave soldering, selective soldering, radial insertion), conformal coating/potting capabilities, as well as various cell/assembly lines allowing for high mix/low volume integration, as well as mass/serial box build assembly. Furthermore, we support our customer in managing complete supply chain management (through sourcing to procurement and supplier management), as well as a range of engineering services and capabilities such as test engineering and development and product management.

E.E: What are the ranges of products?

P.P: I suggest to change this question as follows: What markets segments do you operate in? At Assel, we mainly specialize in supporting Customers within the Industrial and Medical market segments. Examples of applications we support are within the sectors of: security and surveillance, rail, HVAC, renewable energy, IoT, industrial automation.

E.E: What can you tell us about market trends?

P.P: Generally, the demand for electronics manufacturing services is growing globally, which is supported by a general rising tendency to outsource, as well as the fact that electronics is more and more common in more and more types of equipment. Furthermore, due to the Covid-19 lockdowns, the recent supply chain disruptions, as well as geopolitical tensions and rising costs in China – there is an observable trend of “nearsourcing” and returning to manufacturing in local markets.

Nevertheless, although the growing demand – the electronics component market is currently very problematic with lead times ranging one year and above, thus there is an observable need to plan way ahead, which is also related with financial engagement. We observe growing trends in the sectors related to renewable and clean energy, which will most probably grow rapidly following the embargos on Russian gas and oil. Other growing sectors are Medical and IoT.

E.E: What estimations do you have for 2022?

P.P: Our estimations for 2022 and first half of 2023 is further growing trend of nearsourcing, as well as continuous problems with access to electronic materials, especially ICs. With the stronger inflation pressures, which is globally followed by rising interest rates – we expect economic slowdown and thus this may cause lower demand in the end of 2022.