AVK is the oldest interest group in the plastics industry in Germany. The roots of the association date back to 1924, when the Technical Association e. V. (Technische Vereinigung e. V.) was founded. 1959 followed the establishment of the Joint Enterprise Reinforced Plastics e. V. (Arbeitsgemeinschaft Verstärkte Kunststoffe e. V.). Both organizations have finally joined together in 1998 to become AVK-TV, which exists since 2005 under the name AVK – Federation of Reinforced Plastics e. V. (AVK – Industrievereinigung Verstärkte Kunststoffe e. V.).

The AVK, as the German professional association for fibre composite plastics/composites, represents the interests of producers and processors of reinforced plastics/composites on a national and a European level. The AVK currently has over 220 member companies and is therefore one of the largest associations in the European composites sector. It represents members along the entire value-added chain in the area of reinforced plastics. Its members include manufacturers and suppliers of raw materials as well as processing companies, machine-tool manufacturers, engineering firms, testing authorities and scientific institutions. The association represents both small and medium-sized companies as well as major multinational concerns. Members of the AVK are mostly based in the Federal Republic of Germany but also in nearby European countries.

Interview with Dr. Elmar Witten, Managing Director at AVK.

Easy Engineering: What are the main areas of activity of the organization?

Elmar Witten: The AVK primarily works towards achieving the following objectives:

- raising the profile of reinforced plastics in the market and among the general public;

- promoting innovation;

- providing training courses for continuous professional development;

- highlighting the sustainability of the materials & applications;

- improving professional networks still further;

- and supporting the member companies.

With a wide range of services, the AVK supports the members in practice-oriented ways. The services include, among others, representation of interests in politics and the media as well as public relations. The AVK wants to give an understanding of the concerns, goals and tasks of AVK and its members to the decision-makers and citizens through its communications work.

E.E: What’s the news for 2022 about new directions and what can you tell us about market trends?

E.W: After a long period of growth from 2013 to 2018, the corona pandemic, which began in February 2020, as well as other negative factors have severely impacted not only the economy as a whole, but the industrial sector and composites market in particular. European composites production volumes declined by more than 15 % in the period from 2018 to 2020. In 2021, this trend was clearly reversed. With growth of 18.3 %, the market almost returned to its pre-crisis level. The increase was thus significantly higher than overall growth in the EU at 5.3 %. The volume of the global composites market totaled 12.1 million tonnes in 2021, according to the latest figures from the JEC. This represents growth of approx. 8 % over 2020, when the volume was 11.2 million tones.

In comparison, European composites production volume increased by 18.3 % in 2021. The total European composites market thus comprises a volume of 2,962,000 tones (Fig. 1). The market is growing very rapidly and, after just two years, is almost back to the pre-crisis level of 2018 when the market volume was 3,046,000 tones.

Overall, market momentum in Europe was significantly higher than in the global market. Europe’s share of the world market is thus around 25 %, similar to that of the USA. Asia now accounts for around 50 % of global production.

As in previous years, however, the trend within Europe is not uniform. The differences can be attributed to wide variations between the regional core markets, the high variability of the materials processed, the broad spectrum of manufacturing processes and widely differing areas of application. Thus, the growth trends vary from region to region, but above all with regard to the individual processes – although no region and only one procedure recorded declines this year. Only GMT (glass mat reinforced thermoplastics) declined slightly. The following sections present a detailed study of both the regional trends and developments for the respective processes/systems.

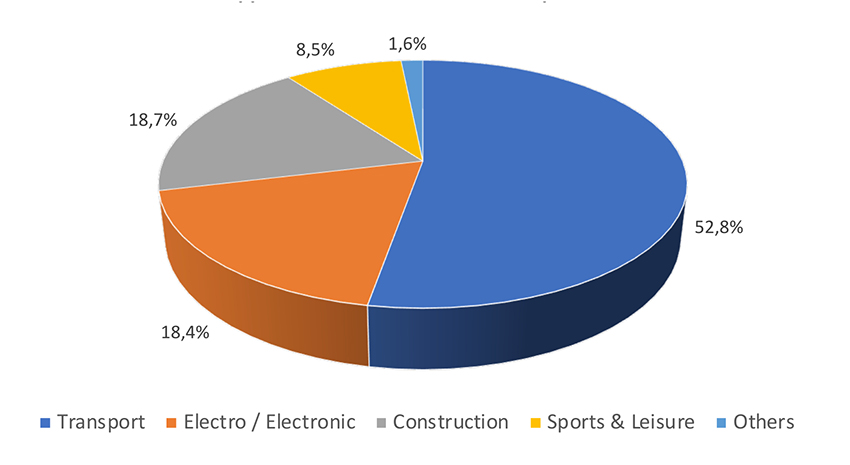

In terms of volume, the largest share of total composites production (50 %) is used in the transport sector (Fig. 2). The next two largest sectors are construction and infrastructure and electro/electronics. CRP volumes are not included as they only account for around 1-2 % of the total market and thus have only a marginal influence on overall market share data.

Global economic and political events currently make it extremely difficult to predict possible future economic development scenarios and thus the trends for the composites market in Europe, either as a whole or for a particular region.

Germany’s transition to renewables accelerated enormously after the nuclear catastrophe in Japan in 2011. This, in turn, increased demand for new forms of energy and the infrastructure to provide them. Wind energy plays a central role here, especially in Germany, but also in other European countries. This is expected to increase considerably over the coming years, both in Germany and Europe.

The area of mobility is also closely linked to energy supplies. Prices for gasoline and diesel have risen enormously in recent months. There are many reasons for this. Firstly, the price of crude oil has risen sharply on the international markets. There is also the new CO2 tax while VAT has been restored to the 2020 level. However, prices sky-rocketed with Russia’s invasion of Ukraine on 24 February this year. Oil supplies no longer seemed secure. Tension in the region had been smouldering for many years and flared up with the annexation of Crimea in 2014. However, even experts did not expect an invasion of this scale. As well as the material damage, as of April there is talk of many thousands of dead and millions have been displaced. Again, this is a single event that is leading to multiple effects. On the one hand, it gives further momentum to the energy transition as a means of reducing dependencies on other countries/regions. This will not only be true for Germany, but for many countries. At the same time, it adds fuel to the debate about alternative drive concepts. For example, with gasoline prices hitting peaks of over EUR 2.30 per litre, switching to electric vehicles (EVs) appears even more attractive. This structural change, too, presents many opportunities for the composites industry. Numerous applications beyond existing components are already emerging. These offer a wide range of new possibilities, such as battery housings/covers for battery packs, where composites have many innate advantages. The expansion of charging infrastructure for EVs also opens up exciting new horizons for composites. Durability, low maintenance and weather resistance are key requirements in this area and composites seem likely to benefit here as well.

Dr. Elmar Witten, Managing Director at AVK

E.E: What estimations do you have for the rest of 2022?

E.W: Overall, the composites industry must be even more successful in promoting the advantages of the materials, not just their lightweight properties, to decision-makers. Corrosion resistance, design freedom, options for load-bearing construction, high strength and rigidity, durability, low maintenance – these are just some of the advantages that need to be more widely understood. The future holds many opportunities, some of which have yet to emerge as the developments of recent years have shown. Composites are materials of the future. The goal must be to ensure they are considered in all material selection processes.