Costmine is a one-of-a-kind comprehensive mine cost estimation and consulting company based in Washington State, USA that has supported mining industry stakeholders since 1983. Their products and software are backed and updated by their in-house mining engineers and cost analysts for use across the life of a mine, from exploration and equipment costing to labor and reclamation. Costmine’s software and publications empower mining industry participants to make reliable mine cost estimates efficiently and confidently.

Interview with Mike Sinden, VP of CostMine Intelligence.

Easy Engineering: What are the main areas of activity of the company?

Mike Sinden: There are several main areas: cost data, software, research, and consulting. As active participants in the mining industry, we know the importance of costing out mining needs, especially in a volatile and connected world economy. We work with a variety of trusted partners to collect costing data, such as salaries and equipment costs, that are then inputted into our static publications and interactive software. We conduct the costing research so our clients don’t have to. We also understand that situations are unique, and our software allows clients to customize parameters surrounding their costing. If a deeper dive is needed, our team is equipped to provide one-to-one support.

E.E: What’s the news about new products?

M.S: We are currently moving our desktop software to the cloud, and we have just lunched our Sherpa Surface model. Next is our Sherpa Underground and Sherpa for Mineral Processing models. These are invaluable cost estimation tools that will now be online. We also excited to further develop and upgrade our APEX Financial Evaluation model. This model allows users to estimate mining asset cash flows, costs, and margins through to valuation. This is a unique offering that will add a lot of value to clients’ workflows.

E.E: What are the ranges of products?

M.S: Our products include both static publications that are updated on a rotating basis throughout the year as well as interactive software which allow our clients to personalize their costing parameters. We also maintain a significant database of mine and mill equipment cost data as well as labour cost data for North America.

We also maintain a vast database of company and property data in our Mining Intelligence platform. This database allows users to search and filter for mine properties globally, containing an array of corporate metrics (financials, capital raisings, M&A) and property metrics (reserves, drill results, production, grade, etc).

E.E: At what stage is the market where you are currently active?

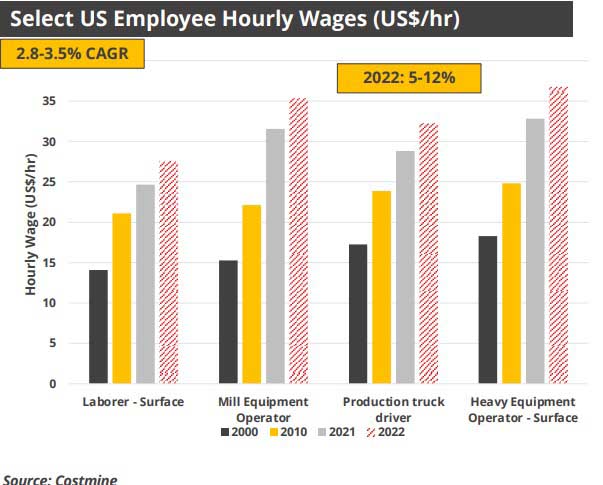

M.S: The mining industry is entering a period of significant development as it tries to meet the needs of the energy transition. With this will come huge interest in commodities such as copper, nickel, cobalt and lithium, but also the potential to create significant inflation as mine project sponsors seek to get their projects developed. The next 10+ years will see increased demand for timely and accurate mine cost data so projects can be developed on time and on budget. Costmine is uniquely placed to meet this demand. Our Mining Intelligence platform will also be a valuable tool in helping investors search and filter for new mine opportunities globally, in order to meet unprecedented demand growth.

E.E: What can you tell us about market trends?

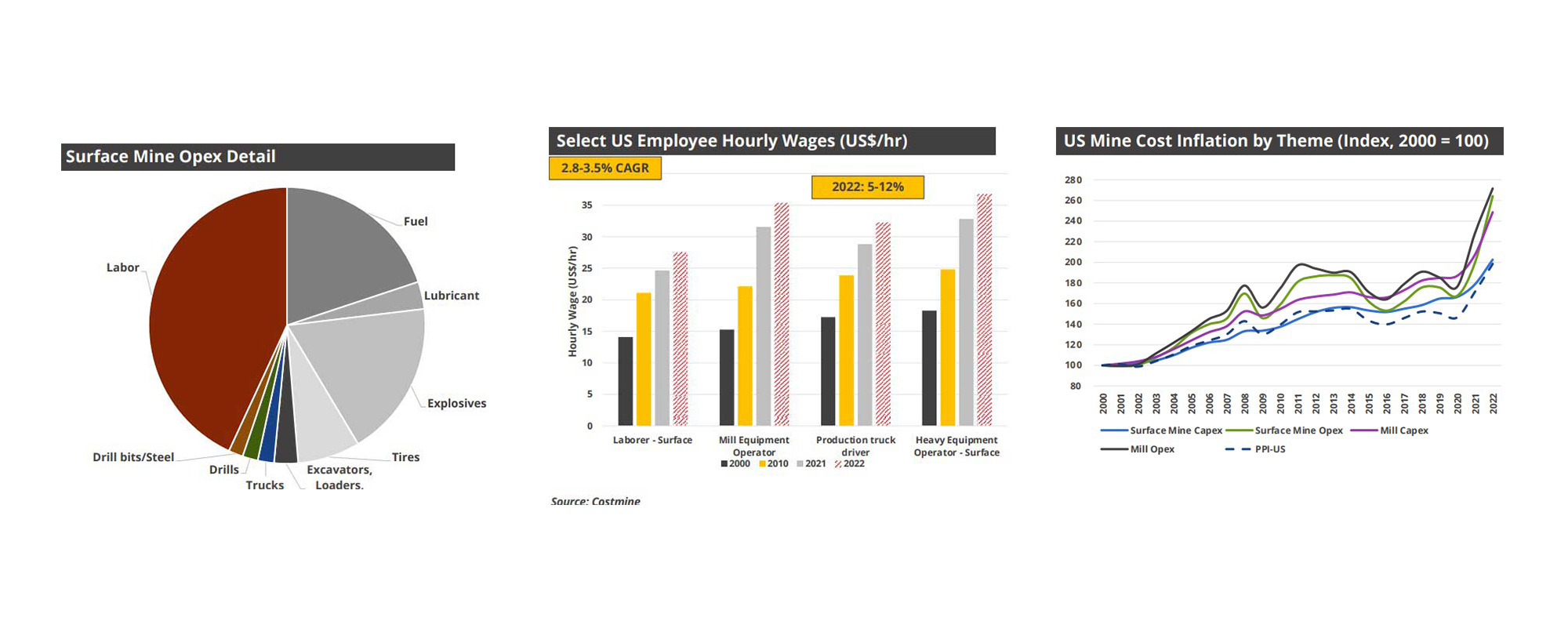

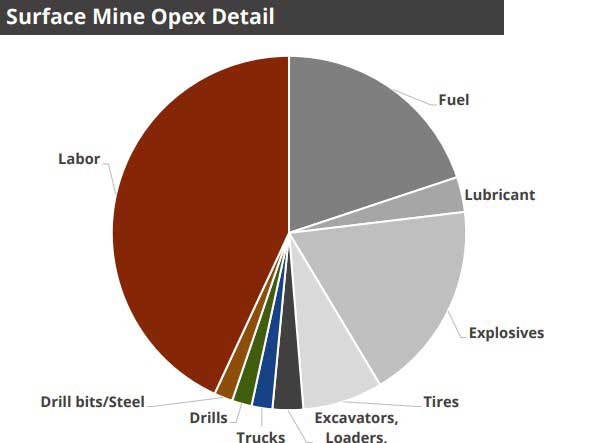

M.S: The rise of hydrocarbon prices has triggered a dramatic increase in operational expenses at mine sites (opex). This has manifested itself in higher commodity prices which in turn spurs renewed interest in developing projects. The labour required to operate and develop projects will be the next catalyst for cost inflation – workers are demanding higher wages just as the need to expand the industry is increasing. Equipment makers will also start to demand higher prices as their input costs (steel, aluminum, labour) rise, creating an inflationary spiral effect in the industry.

E.E: What are the most innovative products marketed?

M.S: Automation to reduce labour costs is one big theme. The ability to operate autonomous vehicles, or have more robotics in underground mines is a trend we will see more of. Automation in mineral processing has also been, and will continue to occur. Electric haul trucks at mine sites is one popular theme but we think the results will be mixed as these trucks are expensive and can be less reliable. They also create more wear on minesite roads and can sometime pose a safety risk, so we think the uptake in these will be slower than people are currently assuming. Another innovation is the ability to revisit old ore waste piles, and with new technologies, extract more metal than was previously possible.

E.E: What estimations do you have for 2023?

M.S: We believe sustained high energy prices will keep opex costs elevated for 2023. We think labour will drive these costs even higher as both unionised and non-unionised workers assert their bargaining power to extract higher wages and benefits.