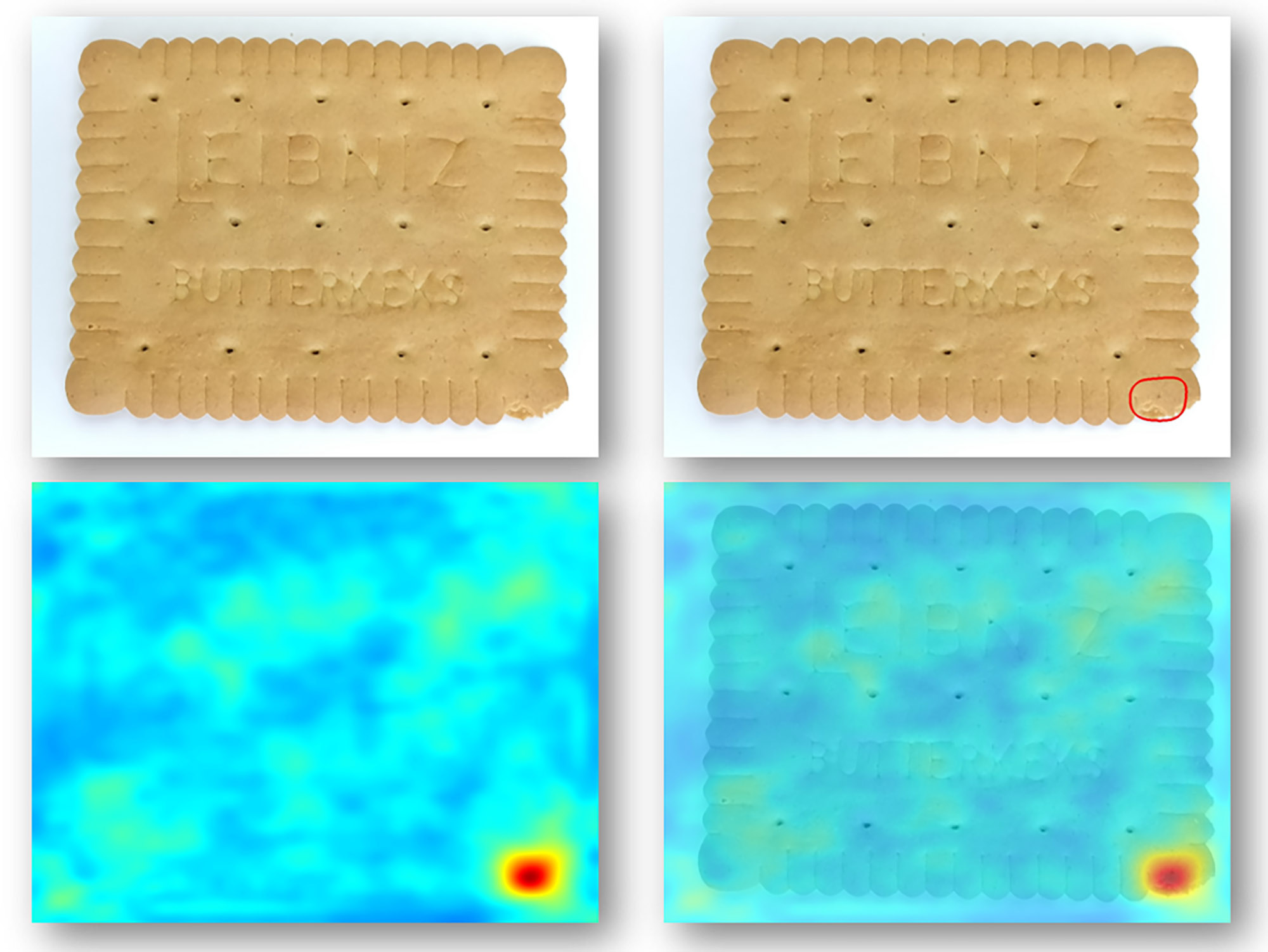

Synsor is an AI start-up from Munich, Germany. Their product prevents of defects in production processes through visual process monitoring. Synsor’s focus lies on providing a product with high usability and a flexible software core that can be adapted and used for multiple different use-cases to achieve actual scalability.

Interview with Benjamin Gosse, CEO of Synsor.

Easy Engineering: What are the main areas of activity of the company?

Benjamin Gosse: We are building deep learning algorithms, but also do a lot of “normal” software engineering to encapsulate our AI into what is a comfortably usable product. Finally, we also work with various camera-types either indirectly via interfaces or directly by buying the cameras ourselves and integrating them into the solution that the customer needs.

E.E: What’s the news about new products?

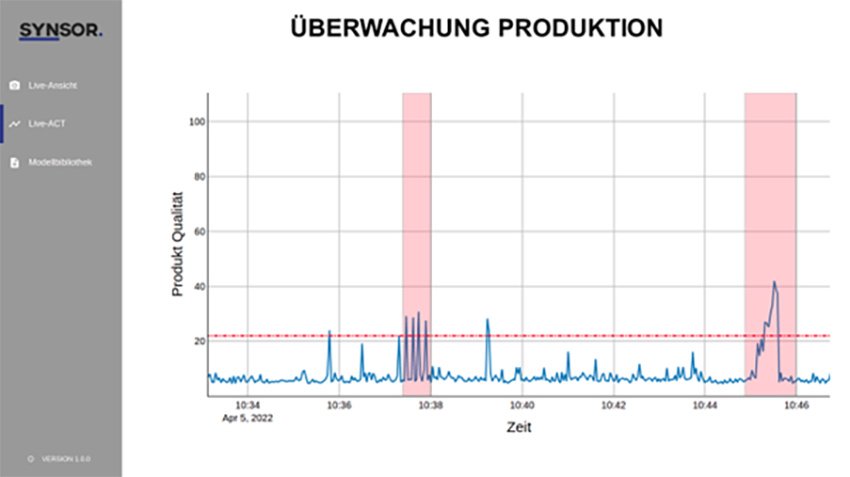

B.G: We launched a first version of defect prevention product, allowing manufacturers to push real time predictions to operators about production process problems. Through our tool, it becomes possible to find “hidden” patterns in existing defects (like numerical patterns) or detect future defects through early trends. In our current production version, the prediction is only displayed locally at the production line, and we are working on a next version that allows different methods of distributions like SMS/Mail or via Web dashboard.

E.E: What are the ranges of products?

B.G: We offer predictive production monitoring and visual quality control. Our clear focus lies on the former, as for the latter, there are a significant number of mature solutions readily available from various vendors. For predictive monitoring, which overlaps significantly with root cause analytics, there are currently only solutions available that are purpose built for the steel industry – thus a big gap in the market to still be filled.

From what we gather, every single manufacturer in central EU/NA struggles with skilled labor shortage. By capturing the knowledge of operators in a predictive system (e.g. by documenting their issue resolution every time), the value of an operator shifts away from being a store of knowledge towards being a flexible thinker that interprets and trains intelligent systems.

E.E: At what stage is the market where you are currently active?

B.G: The market for continuous production processes is generally very mature, as these segments are including paper production, metal rolling, technical textile, cathode production for EV batteries or extrusion processes. While these market segments have different features regarding typical company size, geographical distribution etc., they are all mature markets.

E.E: What can you tell us about market trends?

B.G: From our specific perspective, there is a trend towards simplification and unification. Vision tools have proven their capabilities in general, even though the efforts that companies had to undertake to make these tools work were massive at times. Now, it is about making these types of tools and software modules more scalable, integrateable and user friendly.

E.E: What are the most innovative products marketed?

B.G: The current cutting edge are high performance unsupervised deep learning vision products and non-code data analytics platforms for end-users, in this case for example manufacturing floor quality assurance managers. The adoption rate is very low as manufacturing companies demand high reliability and use existing technical setups for multiple decades at times. So, change rate is relatively low in comparison to other market segments.

E.E: What estimations do you have for the rest of 2022?

B.G: I do believe that larger big data analytics companies or cloud hosting companies like Microsoft or AWS will increasingly start to compete with domain specific vendors like ISRA for space in the manufacturer’s tech stack – at least on the software side of things. This should boost the number of offerings out there but also the speed of progress and the maturity of the available tools and solutions. And of course, I would be biased in this direction as a good way for bigger companies to break into specific domains is the acquisition of small-scale companies with the necessary industry expertise and technical skillset 😉