Supplyframe is a leading provider of SaaS solutions that support product development and sustainment, from engineering and design, all the way through to sourcing and supply management. Over the past 20 years, the company has been at the forefront of innovation across the electronics value chain, providing engineers and sourcing professionals with real-time insights into component availability, price, lead time, and design resources.

Today, more than 12 million electronics and supply chain professionals engage with Supplyframe’s SaaS solutions, search engines, and media properties, transforming how people design, source, market, and sell their products. The company’s Design-to-Source Intelligence leverages billions of signals covering demand, design, intent, supply, and risk factors to support decision making across the electronics value chain.

Supplyframe was acquired by Siemens in 2021 and is headquartered in Pasadena, Calif., with offices around the globe.

Interview with Richard Barnett, CMO at Supplyframe.

Easy Engineering: What are the main areas of activity of the company?

Richard Barnett: As much as 80% of lifecycle cost and risk is locked in at the point of design. As we’ve seen in recent years, this can create massive challenges when even a single component becomes unavailable due to supplier disruptions, spikes in demand, or as equipment reaches end-of-life. Supplyframe is committed to delivering outside-in intelligence early and often across product development and sourcing processes so engineering teams can build with confidence and companies can ensure supply is there when they need it. In doing so, Supplyframe customers can effectively “shift left” and avoid unforeseen disruptions and cost overruns from product development all the way through to sustainment.

E.E: What’s the news about new products?

R.B: Supplyframe is constantly working to enhance its Design-to-Source Intelligence solutions so teams can perfect bills of materials and make timely, strategic sourcing decisions while reducing costs and accelerating product development cycles. To that end, Supplyframe has developed a set of solutions that can be rapidly deployed without the need to replace existing systems of record, enabling constant innovation and seamless integration with existing EDA and product lifecycle management tools. Supplyframe has also enhanced its strategic sourcing solution, Commodity IQ, to deliver predictive insights and intelligence across more than 275 individual commodities. By combining real-time market intelligence with purpose-built solutions for design-to-source processes, OEMs and contract manufacturers no longer have to wait for the next negotiation cycle or engage in costly spot buys.

E.E: What are the ranges of products?

R.B: Supplyframe offers solutions that span the global electronics value chain so manufacturers across industry verticals such as automotive, aerospace and defense, industrial equipment, medical devices, and consumer electronics can make intelligent solutions across the product lifecycle. Because it also operates the world’s largest network of vertical media, search, and communities dedicated to electronics, Supplyframe also enables component manufacturers and distributors to increase their design wins and grow revenue by connecting to a global audience of engineers and sourcing professionals.

E.E: At what stage is the market where you are currently active?

R.B: Supplyframe is operating in a market that has long been underserved by technological innovations and new software capabilities. Although everyone has access to mature EDA systems, ERPs, and procurement solutions, there has been a lack of dedicated investment to intelligent solutions that support design-to-source processes. Supplyframe’s customers are at the forefront of a new wave of solutions that enable greater intelligence, communication, and collaboration from the point of design all the way to sourcing and supply management.

E.E: What can you tell us about market trends and what estimations do you have for 2023?

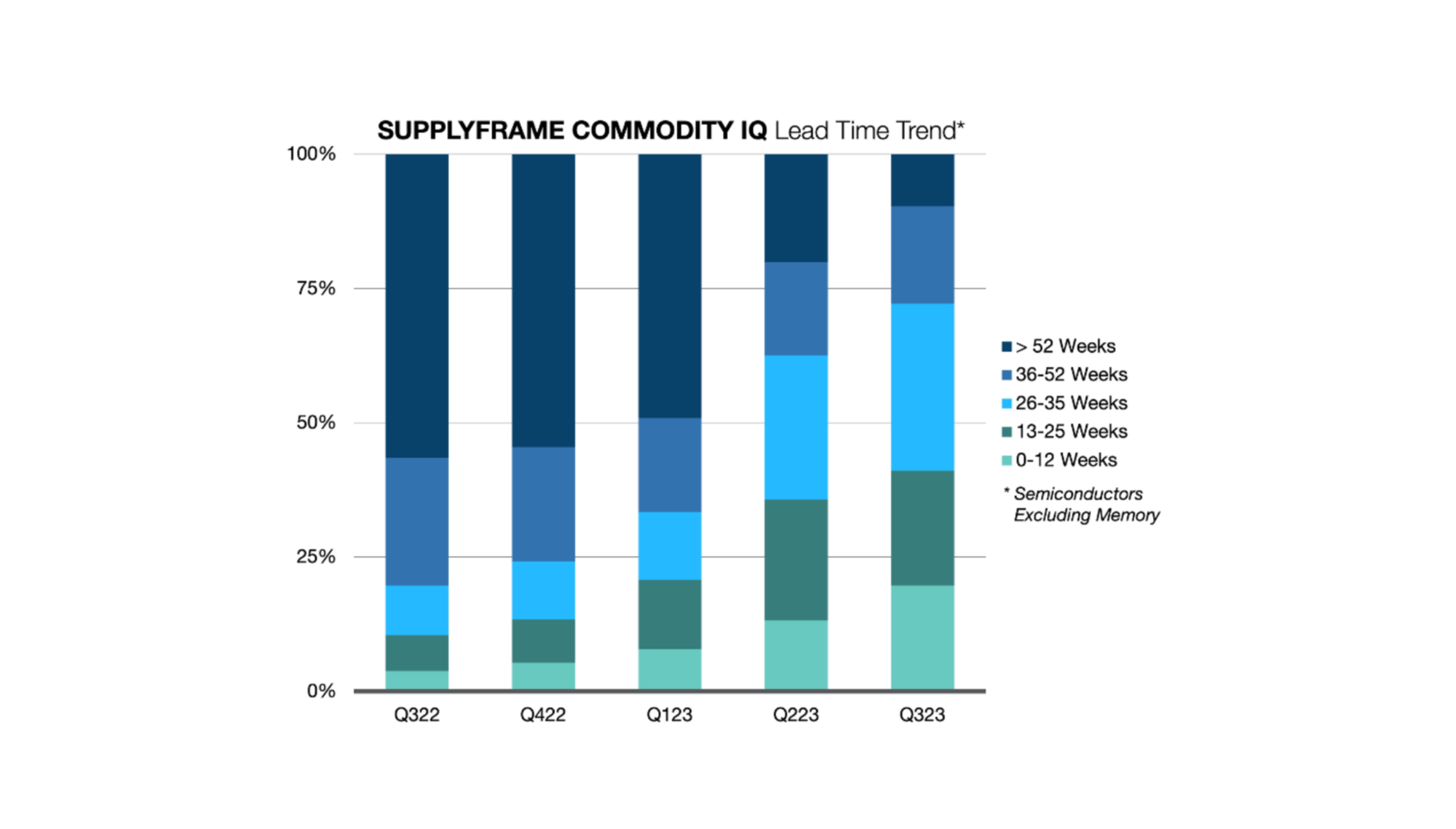

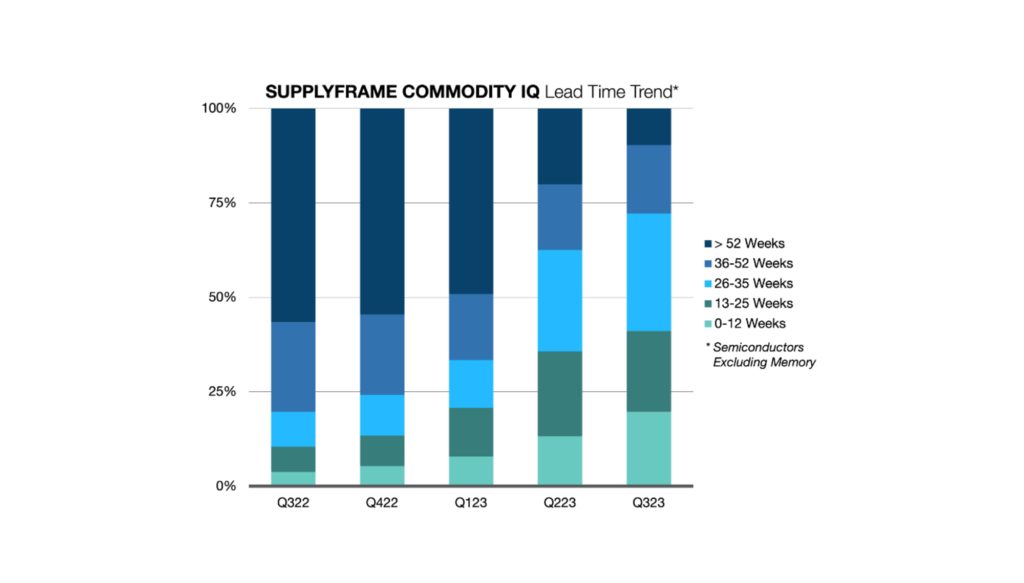

R.B: Most electronic component lead times will continue to improve through H2 as global demand for consumer, PC, data center, and mobile markets remains soft, and ecosystem inventories are at record highs. Meanwhile, strong demand and extended lead times persist for product families supporting artificial intelligence (AI), automotive, and select industrial segments, including battery and energy management applications.

Electronics supply chain inventories, previously expected to peak in Q4 2022, remain stubbornly high at component manufacturers, distributors, EMS providers, and OEMs. Chinese economic recovery has been slow to materialize, further hampering inventory drawdowns.

We now believe inventories have largely peaked – with channel and supplier partners having aggressively reduced output and order coverage except for complex semiconductors, discrete ICs, and industrial and automotive product categories.

While raw material pricing has peaked, costs remain above pre-pandemic levels. The same is true for logistics costs. We expect continued improvements in H2 for both areas. Finally, global labor inflation and shortages – from contingent labor to logistics positions and from microelectronic engineers to technical staff – will continue to be challenges within the electronics industry heading into H1 2024.

E.E: What are the most innovative products marketed?

R.B: For decades the industry has relied on the same old tools, spreadsheets, and rigid software to design, source, and plan for an unpredictable future. But as the rate of electronics product innovation has accelerated, the world has come to see that static data and backwards-looking analysis are a poor way to predict the future. The most innovative solutions marketed are those that bring intelligence and predictive insights right to the point where they’re needed the most.